Market research firm Infonetics Research (http://twitter.com/infonetics) released its fourth quarter 2010 (4Q10) IMS Equipment and Subscribers market share and forecast report. "Fixed-line network deployments, including those by mobile operators, drove the IMS equipment market in 2010, while equipment spending for mobile services (PoC over IMS, mobile IM, RCS) was minimal. However, activity for mobile IMS-based services will increase in 2011, as we see the launch of mobile video calling from operators such as SK Telecom and Rich Communication Suite from Vodafone, in addition to select operators such as Verizon Wireless gearing for VoLTE deployments in early 2012," expects Diane Myers, Infonetics Research’s directing analyst for VoIP and IMS.

IMS MARKET HIGHLIGHTS

* The fourth quarter historically is the strongest for IP Multimedia Subsystem (IMS) equipment, and 4Q10 was no exception, with a 41% increase in worldwide revenue over 3Q10

* On an annual basis (a better gauge in a characteristically lumpy market), IMS equipment spending grew 24.4% in 2010 to $503.6 million

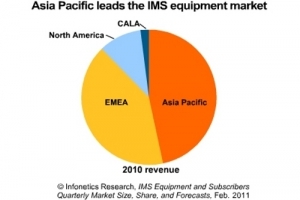

* In 2010, the IMS market was strongest in Asia Pacific, particularly China, Japan, South Korea, Thailand, Vietnam, and Malaysia

* The top IMS equipment vendors—Alcatel-Lucent, Ericsson, Huawei, and Nokia Siemens Networks—continue to battle it out, with Alcatel-Lucent scoring big in 4Q10, garnering roughly a quarter of worldwide CSCF revenue

REPORT SYNOPSIS

Infonetics’ quarterly IMS report provides worldwide and regional market size, market share, forecasts through 2015, and analysis of mobile and fixed-line IMS subscribers and equipment. Equipment tracked includes IMS voice and IM/presence application servers and IMS core equipment, including home subscriber servers (HSS), call session control function (CSCF) servers, media resource function (MRF), breakout gateway control function (BGCF), and media gateway control function (MGCF). The report includes an IMS deployment tracker by region, country, carrier, and vendor. Vendors tracked include Alcatel-Lucent, BroadSoft, Ericsson, Huawei, Mavenir, Nokia Siemens, ZTE and others.

The full version of this report with in-depth analysis will be available on or before March 1, 2011.

RELATED RESEARCH

* 42% jump in session border controllers (SBCs) boosts 2010 carrier VoIP market

* Rich Communication Suite (RCS) relegated to niche status

* N. American carriers to reap $246B from residential video, voice, Internet services in 2010

* Demand up, prices down for carrier VoIP and IMS equipment, led by China

* Session border controller survey shows growing use of SBCs for VoIP interconnection

* Business VoIP service revenue up 8% in 1H10

* BT, T-Systems, Vodafone top hosted business VoIP services leaders in EMEA

UPCOMING VOIP AND IMS MARKET RESEARCH

See SERVICE PROVIDER VOIP AND IMS on Infonetics’ portal (http://www.infonetics.com/login) for more:

* Analysis Report: 4Q10/2010 Service Provider VoIP Equipment and Subscribers

* Analysis Report: 4Q10/2010 IMS Equipment and Subscribers

* Enterprise Unified Communications, VoIP, and TDM Equipment Report

* Total Service Provider VoIP and IMS Equipment and Subscribers Pivot

* VoIP and UC Services and Subscribers with Service Provider Scorecard

* North America Business VoIP Services Leadership Matrix

* IMS Services Strategies, Product Features, and Vendor Leadership: Global Service Provider Survey